Analysts: Permian Holds Seeds Of Production Growth

As oil and gas production continues to decline in basins across Texas, the Permian Basin still holds the potential for impressive economic returns and substantial production growth, according to a recent report by Bernstein Research.

Catalyzed by the shale revolution, U.S. producers added nearly 4 million barrels per day (MMbbl/d) starting in 2011, with Texas contributing more than half of that growth, the analysts said. Texas producers began pumping the brakes as oil prices collapsed, but production in the Permian Basin “has been growing in a time when others are struggling to stay flat,” according to the report.

“The shale revolution may have begun in gas and may have landed on other plays following that, but it has clearly ended in the Permian,” they said.

The basin makes up about one-fifth of U.S. oil production today. Legacy and “non-horizontal” or non-shale growth has been maintained at 1 MMbbl/d since 2011, with roughly 1 MMbbl/d of horizontal growth.

Currently, Permian production is composed of about 0.5 MMbbl/d of legacy, 0.5 MMbbl/d of non-horizontal growth and nearly 1 MMbbl/d of horizontal growth, which was increasing 0.25 MMbbl/d year-over-year since 2011, the analysts said. Of the horizontal growth, 0.5 MMbbl/d is from the Delaware, 0.35 MMbbl/d is from the Midland and the negligible remainder is from other basins.

The Permian Basin has proven that it has significant inventory, that it can grow and that it can generate “powerful economic returns.” These factors, coupled with its low geopolitical risk, have garnered the attention of the more than 27 integrateds and publicly traded E&Ps with exposure in the basin, the report found.

Bernstein’s own coverage identifies seven public companies with exposure: Apache Corp. (NYSE: APA), Anadarko Petroleum Corp. (NYSE: APC), ConocoPhillips (NYSE: COP), Devon Energy Corp. (NYSE: DVN), Encana Corp. (NYSE: ECA), EOG Resources Inc. (NYSE: EOG) and Noble Energy Inc. (NYSE: NBL).

The Permian owes its steady production levels to its rig count, which has fallen slowly and minimally compared to other plays. Although non-Delaware and non-Midland counts “have hit record lows and in some cases even zeroed out,” key Midland counties to the west “have maintained their share.”

Well productivity isn’t why rigs haven’t fallen as fast in the Permian, as compared with the higher rates in individual wells in the Bakken and Eagle Ford, Bernstein reported. Instead, Permian rigs were kept in the field thanks to growth operators who were hedged, ensuring the cash flow needed to continue high levels of activity and the basin’s potential for growth.

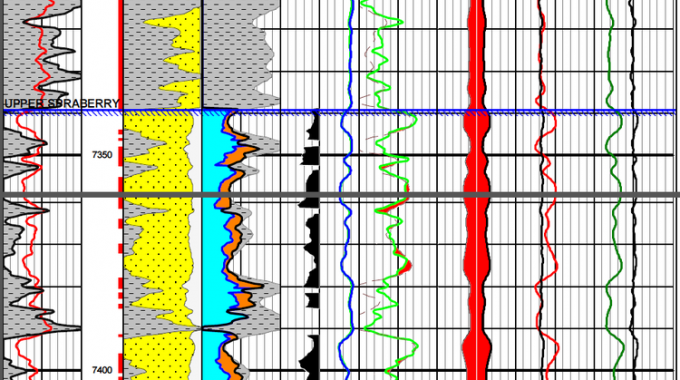

Lateral lengths, another component in Permian production, experienced “massive year-on-year growth” from 2007 to 2013. But according to recent data, growth is approaching single digits.

In 2009, both Delaware and Midland wells’ laterals were about 3,000 feet. Now, the “Midland Basin has grown to 7,500 feet while the Delaware only 5,500 feet.” The Delaware’s shorter wells result from “checkerboarding,” or railroad land grants’ effect on acreage ownership, and could be remedied by joint ventures and acreage swaps, the analysts said.

The Midland Basin to the east has experienced a plateau in lateral lengths for the last few years, while the Delaware Basin has recently stepped up its pace. The Delaware “has the most to gain in capital efficiency” and “looks like the long-term winner” in projected long-lateral development, according to Bernstein.

At the moment, the Midland appears more valuable, yielding $10,000 to $25,000 per acre, with an average of $13,480/acre last year. Prices in the Delaware are rising from their current average of $6,640/acre.

Meanwhile, “in practice, the equity market appears to place a value of $20,000 to $40,000/acre on the Permian acreage of most operators,” the analysts said.

A Permian E&P company is worth owning, they said, because of its ability “to generate future discounted cash flow significantly in excess of a) its costs, b) its valuation and c) its peers.”

The analysts attributed this notable cash flow to a Permian E&P’s capacity to drill more wells and have wells that both return cash flow quickly and generate greater cash flow than capex.

Top E&Ps operating in the Permian include EOG, which boasts some of the longest laterals and “is improving the fastest in the basin,” according to Bernstein. On the other end of the spectrum, Anadarko “has the most room for improvement on well cost … well productivity needs to improve at the same time.”

Apache’s acreage position is significant, but the company may reap more benefits if it focuses on core holdings, whereas ConocoPhillips could profit from “upsizing exiting the basin or deploying capital elsewhere,” according to the report.

In all, the Permian Basin “is the last large arena for oil production growth in the U.S,” Bernstein concluded.